Of developments in the fintech space, with traditional banks transferring to online spaces, abandoning legacy infrastructure in favour of cloud based platforms, and fintech partnerships, to name a few.

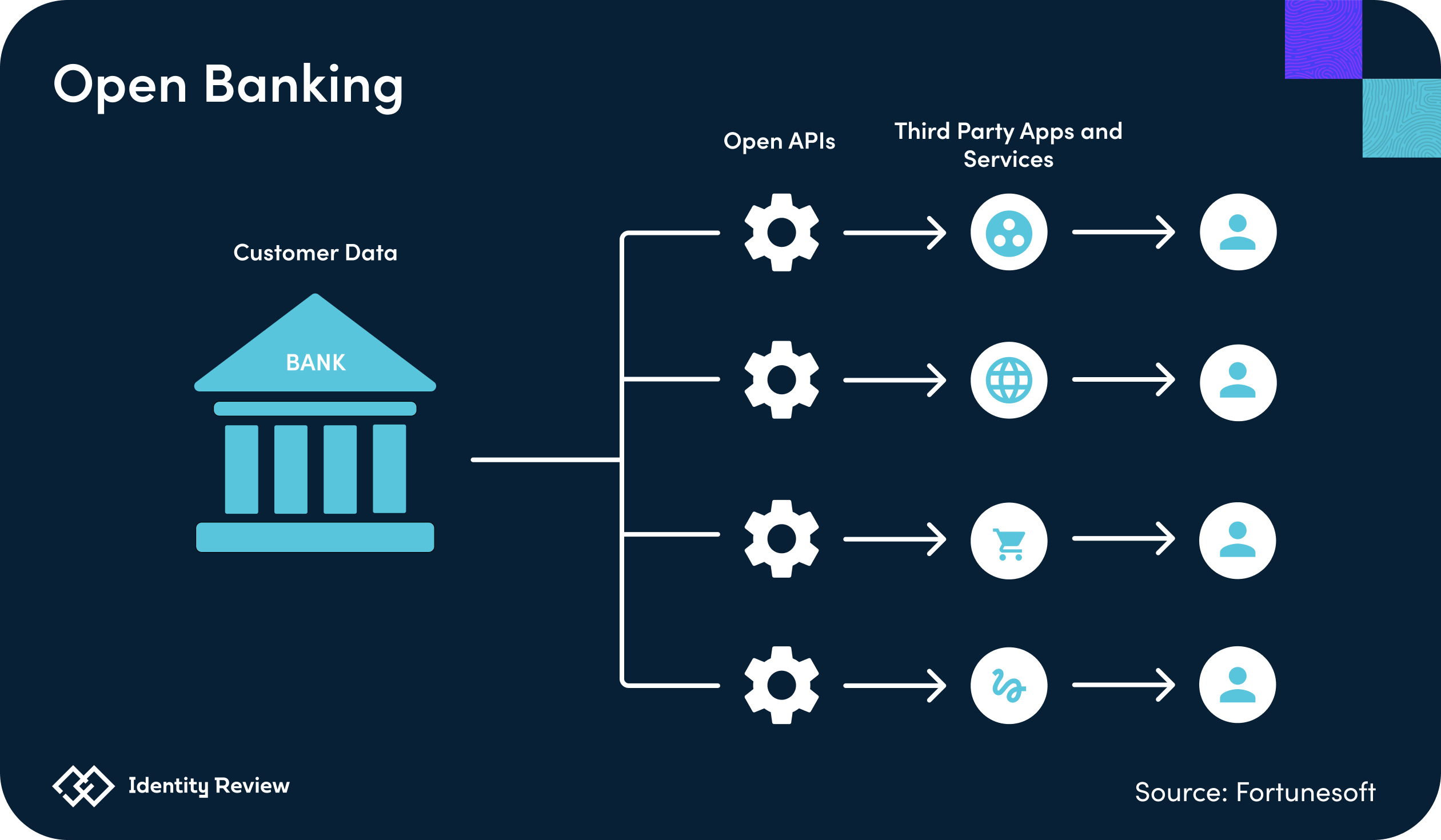

Additionally, the implementation of app-based transactions and digital banking has led to an influx The open banking ecosystem has evolved and flourished in recent years, allowing consumers to make seamless transactions online and on their mobile devices. “Wells Fargo has always been a great partner at the forefront of innovation, so it was a natural fit for them to be our first major partner as we launch this exciting new endeavor.As open banking is embraced worldwide, we have taken a look at how different countries are approaching open banking, and the countries paving the way toward open finance. “Bank integrations have been in the Expensify DNA since day one, and the ExpensifyApproved! Banks program is the next step toward providing a consistent transaction import process for our mutual customers,” says David Barrett, founder and CEO of Expensify.

The new method of data sharing between Wells Fargo and Expensify – driven by an innovative new application-programming interface (API) – gives enhanced security and greater control over what bank information is shared with Expensify.

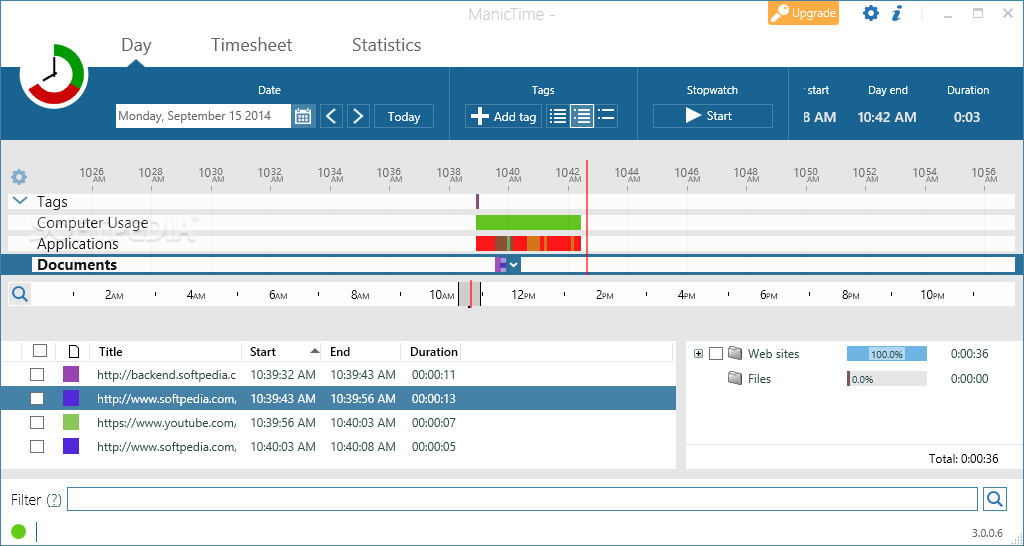

#Finkit for open banking software#

This relationship will allow the two firms to continue to deepen their existing agreement on creating an innovative and more reliable data sharing platform for mutual Expensify and Wells Fargo customers who use the Expensify software to manage their expenses.

Key destinations include The Souk, an elegantly designed precinct featuring jewellery shops, accessory outlets, traditional Arab clothing and handicraft stores or The Village, which offers a rich collection of denim brands and brings an outdoor community feel with tree-lined walkways, cafés and restaurants or the newly expanded Fashion Avenue, which provides a significant boost to Dubai’s premium shopping options, with over 150 luxury shopping and dining experiences including flagships and new concepts.Įxpensify, a premier innovative expense reporting app provider, launched the ExpensifyApproved! Banks program today at ExpensiCon with Wells Fargo as its first major partner. With the remarkable growth and importance of Chinese tourism to Dubai, The Dubai Mall is continuing to look at ways to accommodate their needs, which includes multilingual Guest Services staff and Chinese language Mall Guides.Ĭhinese visitors can now look for stores across The Dubai Mall through Alipay’s in-app Discover platform, and pay for their orders in RMB via Alipay at the cashiers. “Sound strategic choices taken while these regulations are in their infancy will allow institutions to manage their resources to ensure compliance today, and to focus on innovation and competitiveness long-term.”Ĭhinese visitors can now use Alipay in The Dubai MallĪlipay, online and mobile payment platform operated by Ant Financial Services Group, and The Dubai Mall, the world’s largest and most-visited retail and entertainment destination, located in the heart of the prestigious Downtown Dubai, jointly announced that Chinese mainland visitors can now use Alipay to pay for a wide range of shopping, dining and must-see leisure attractions.

“Though PSD2 and Open Banking are chiefly viewed as regulatory requirements, they represent a significant opportunity for banks to partner with trusted third-party providers to integrate financial services into their customers’ everyday lives, while also driving more innovation inside the banks,” said Ken Paterson, vice president, Special Projects, Mercator. As a result of these regulations consumers will be able to access financial information and initiate certain transactions previously only available through financial institutions through other parties they trust and interact with regularly.įinKit for Open Banking is designed to enable immediate and long-term compliance with these regulations and put in place the capabilities required for banks to maximize the opportunity of open banking. The move toward open banking, driven by the European Union’s Second Payment Services Directive (PSD2) and the United Kingdom’s Open Banking Implementation Entity (OBIE), will transform financial services. Fintech, Finance, Technology, Banking Highlights – 26 April 2018įiserv, a global provider of financial services technology, has launched FinKit for Open Banking to help financial institutions meet and keep pace with rapidly unfolding regulations.

0 kommentar(er)

0 kommentar(er)